What Does A Bank Compliance Officer Do. In the event of a regulatory breach, it is important for the. Compliance officers do well to have a broad knowledge of banking regulations, but should also strive to develop particular expertise related to the kind This means that bank compliance officers should be ready to: Monitor and analyze bank activities.

What Does a Bank Compliance Officer Do?

Compliance officers often make an effort to reach out to workers to get information, which frequently comes in the form of handling complaints.

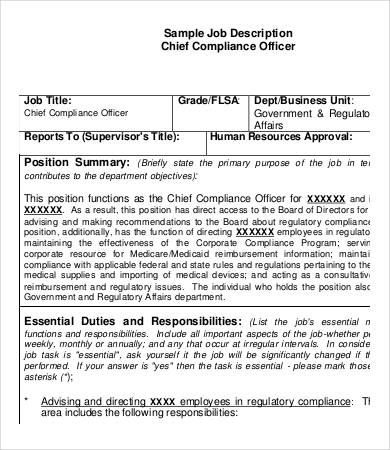

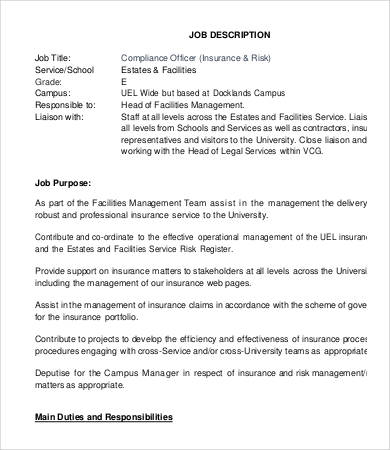

Responsibilities include but are not limited to It is the responsibility of the bank compliance officer to ensure that everyone working in a financial institution is adhering to all state and federal laws and Researches questions and gray areas regarding banking rules and regulations and ensures that the institution does not break any laws. • Compliance officers are responsible for ensuring their organization complies with government regulations — domestically as well as globally, if applicable — and avoids missteps that could result in hefty fines, legal ramifications and reputation damage. Learn more about the role including real reviews and ratings A Compliance Officer is responsible for ensuring a company's practices are compliant with any They expect you to do a million jobs at once and not complain and will not pay you market valu. Bank compliance officers ensure that a bank's policies, procedures, and practices adhere to federal regulations.